How Much is Palmpay POS? A Comprehensive Guide to Palmpay’s POS

Are you wondering how much is PalmPay POS? Don’t worry, I’ve got you covered.

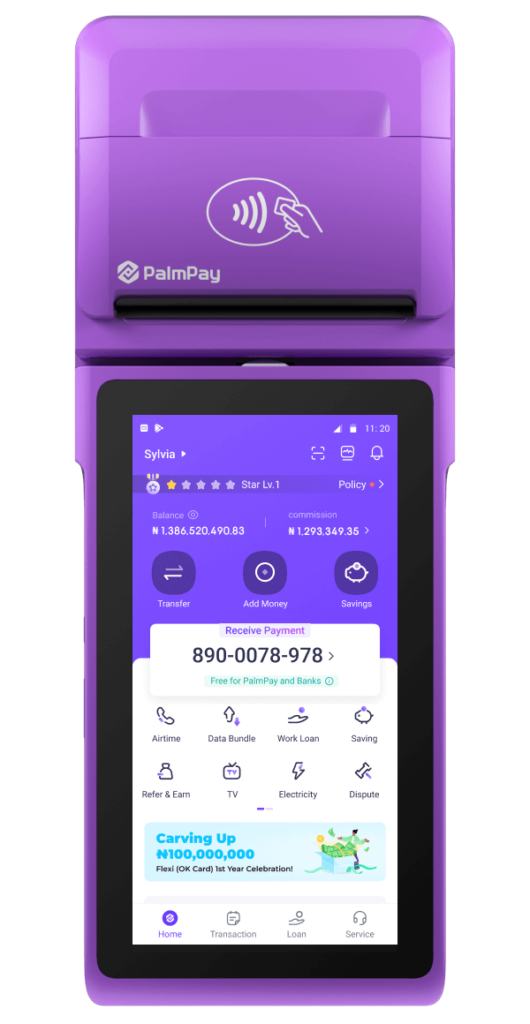

PalmPay is a digital payment platform that allows users to transact using their mobile devices.

The PalmPay POS is a portable point-of-sale device that allows merchants to accept payments anywhere, making it convenient for small businesses.

The cost of the PalmPay POS is a common question among merchants interested in using the device.

The price of the PalmPay POS varies depending on the model and features of the device. PalmPay offers affordable pricing for merchants, allowing them to accept payments via card, QR code, and mobile money transfers.

Overview of PalmPay POS and Price

The cost of the PalmPay POS ranges from 30,000- 60000 Naira.

The price of the PalmPay POS varies by model and features.

This user-friendly, secure, and reliable point-of-sale solution allows merchants to accept payments from Mastercard, Visa, and Verve cards, increasing sales potential.

PalmPay POS also offers inventory management, sales reporting, and customer relationship management.

It’s competitively priced, making it accessible for small and medium-sized businesses.

Overall, PalmPay POS helps businesses of all sizes accept payments and manage operations efficiently.

Cost Structure of PalmPay POS

Purchase Price

The purchase price of a PalmPay POS device is currently set between 30K-60K.

This price includes the device itself, as well as any necessary software updates and technical support.

The company offers discounts for bulk purchases, with prices dropping to $90 per device for orders of 10 or more.

Transaction Fees

PalmPay charges a transaction fee of 1.5% for all transactions processed through its POS device.

This fee is deducted from the total transaction amount, and the remaining balance is deposited into the merchant’s account.

The company does not charge any additional fees for processing refunds or chargebacks.

Monthly Service Fees

PalmPay does not charge any monthly service fees for its POS device.

However, merchants are required to maintain a minimum balance of $50 in their PalmPay account at all times.

Failure to maintain this balance may result in account suspension or termination.

Overall, PalmPay’s cost structure for its POS device is competitive within the industry.

Though its purchase price is slightly higher, the lack of monthly service fees and reasonable transaction fees make it a solid option for merchants.

Related Posts:

- POS Business in Nigeria: 7 Must-Dos for Success

- Kudi POS Machine: A Guide to Obtaining it in Nigeria

- 11 Investment Banks in Nigeria: A Comprehensive List of Top Players in the Industry

- How to Delete PalmPay Account Without Stress

- How to Borrow Money from Palmpay With or Without BVN

- Palmpay USSD Code: The Complete Guide

Features and Benefits

Security Features

Palmpay POS offers top-notch security features to ensure that all transactions are safe and secure.

The POS device comes with an inbuilt biometric scanner that allows only authorized users to access the device.

Additionally, the device has a tamper-proof casing that ensures that the device is not compromised.

Palmpay POS also uses end-to-end encryption to secure all transactions, ensuring that sensitive data is not compromised.

User Interface and Experience

Palmpay POS has a user-friendly interface that makes it easy for users to navigate and use the device.

The device has a large screen that displays all the transaction details, making it easy for users to verify the transaction before completing it.

Palmpay POS also has a fast processing speed, ensuring that transactions are completed quickly, and reducing wait times for customers.

Integration with Other Services

Palmpay POS is designed to integrate with other services, making it easy for businesses to manage their operations.

The device can be integrated with accounting software, allowing businesses to keep track of their finances in real time.

Palmpay POS can also be integrated with inventory management software, making it easy for businesses to manage their inventory levels.

Overall, Palmpay POS offers a range of features and benefits that make it an ideal choice for businesses looking for a reliable and secure POS solution.

Palmpay POS is a smart investment for any business with its advanced security, easy-to-use interface, and seamless integration with other services.

Acquiring a PalmPay POS

Eligibility Criteria

To acquire a PalmPay POS, certain eligibility criteria must be met. The applicant must be a registered business owner with a valid business name and address. Additionally, the business must have a verifiable source of income and a good credit history.

Application Process

To apply for a PalmPay POS, the applicant must visit the nearest PalmPay agent or office and provide the necessary documents. These documents include a valid means of identification, a passport photograph, a valid business registration certificate, and a utility bill. The applicant will also be required to fill out an application form and provide details about their business.

Setup and Activation

Once the application is approved, the applicant will be required to pay a one-time fee for the POS device. The device will be set up and activated by a PalmPay technician, who will provide training on how to use the device. The device can be linked to the applicant’s bank account for easy transactions.

In conclusion, acquiring a PalmPay POS is a straightforward process that requires meeting certain eligibility criteria and going through an application process. The device can be set up and activated by a PalmPay technician, who will provide training on how to use the device.

Support and Maintenance

Customer Support Services

Palmpay POS offers comprehensive customer support services to ensure that all users are satisfied with the product.

The company has a dedicated customer service team available to assist users with any issues they may encounter while using the POS system.

Users can reach out to the customer service team via email, phone, or live chat.

The team is available 24/7 to provide support and assistance to users.

Warranty and Repairs

Palmpay POS comes with a warranty that covers any defects or malfunctions that may occur within the first year of use.

The warranty covers repairs and replacement of parts, free of charge.

In case of a defect or malfunction, users can contact the customer service team to initiate the repair or replacement process.

Palmpay POS also offers repair services for users whose warranty has expired. Users can contact the customer service team for more information on repair services.

Software Updates

Palmpay POS regularly releases software updates to improve the functionality and security of the POS system.

These updates are designed to fix any bugs or vulnerabilities that may be present in the system.

Users are advised to regularly update their Palmpay POS software to ensure that they are using the latest version of the system.

Users can easily update their software by following the instructions provided on the Palmpay POS website.

Palmpay POS provides comprehensive support and maintenance services to ensure that users have a seamless experience while using the POS system.

The company’s commitment to customer satisfaction is evident in the quality of its customer support services and its warranty and repair policies.

Comparative Analysis

Comparison with Other POS Systems

When it comes to comparing PalmPay POS with other point-of-sale systems, it is important to consider the features, pricing, and ease of use.

In terms of features, PalmPay POS offers a range of functionalities that are similar to other POS systems in the market.

However, one of the unique features of PalmPay POS is its ability to accept payments from multiple sources, including bank transfers, card payments, and mobile money.

In terms of pricing, PalmPay POS is competitively priced compared to other POS systems in the market.

The company offers a range of pricing plans that are designed to meet the needs of small and medium-sized businesses.

PalmPay POS does not charge any setup fees, which makes it an attractive option for businesses that are just starting.

When it comes to ease of use, PalmPay POS is designed to be user-friendly and intuitive.

The system is easy to set up and needs minimal training, ideal for businesses without a dedicated IT department.

Pros and Cons

Like any other POS system, PalmPay POS has its pros and cons.

Some of the pros of using PalmPay POS include its ability to accept payments from multiple sources, its competitive pricing, and its user-friendly interface.

Also, PalmPay POS offers a range of features that are designed to help businesses manage their sales and inventory more effectively.

However, there are also some cons to using PalmPay POS.

One of the main drawbacks of the system is its limited offline capabilities.

While the system can still process payments when offline, it does not offer the same level of functionality as when it is connected to the internet.

PalmPay POS does not offer as many integrations with third-party apps and services as some other POS systems in the market.

Finally, PalmPay POS is a solid option for businesses that are looking for a user-friendly and competitively-priced POS system.

While it may not offer as many features or integrations as some other systems in the market, it is still a reliable and effective option for businesses of all sizes.

FAQ

How Much Does a POS Machine Cost Now?

The cost of a POS machine in Nigeria varies depending on the brand and features. Typically, prices range from ₦30,000 to ₦100,000 or more.

Here are the current prices for POS machines and Opay:

How much is the price of Opay?

Anywhere between 35000-50000k

Opay, a popular financial service provider in Nigeria, offers various services including mobile money and payment solutions.

Prices for specific Opay services like POS terminals can vary, and it’s best to check directly with Opay or their authorized agents for the latest pricing details.

Bottom Line

The price of POS systems in Nigeria varies based on features and models, but they generally offer affordable options for businesses of all sizes.

With benefits like advanced security, user-friendly interfaces, and multiple payment acceptance channels, investing in a POS system can enhance operational efficiency and boost sales.

Whether you’re a small business or a large enterprise, the right POS system is a valuable tool for streamlining transactions and improving customer service.

Recommended Artilces: